Commentary March 2010

Figures published by the Office of National Statistics today showed that the rate of inflation

measured by the Consumer Prices Index (CPI) fell from 3.5% p.a. in January 2010 to 3% p.a. in February.

This is good news for savers as inflation is starting to move in the right direction. However,

inflation measured by the Retail Price Index (RPI) remained unchanged at 3.7% p.a. The main reason

for RPI inflation remaining high was due to mortgage costs remanining static between January and

February 2010 whereas these costs fell a year ago due to base rate cuts.

Even with inflation falling to 3%, taxpayers would need to earn gross returns of 3.75% (basic rate taxpayer), 5% (higher rate taxpayer) or 6% (50% taxpayer) for their savings to keep pace with inflation.

The picture of cash here should make you feel good. An article published in this month's Harvard Business Review finds that cash gives

people an inner strength and can reduce their physical and emotional pain. Simply the idea of cash has this effect.

The picture of cash here should make you feel good. An article published in this month's Harvard Business Review finds that cash gives

people an inner strength and can reduce their physical and emotional pain. Simply the idea of cash has this effect.

Kathleen Vohs, an associate professor of marketing at the University of Minnesota's Carlson School of Management, carried out a study

where she asked some participants to count cash and others to count slips of paper and then put them in painful situations and asked them

to rate their feelings. She found that having money makes people feel strong and lacking it makes them feel weak. People became more

self-sufficient due to money and simply being in the presence of money (even a picture of money) made people work harder, they were less

distracted, more focussed and more productive. She suggests that cash could be a good motivator in business either to lessen the impact

of a customer's pain if there is a problem, or to motivate employees.

Read the full article on the HBR website.

Source: Vohs, Kathleen, (2010), The Mere Thought of Money Makes You Feel Less Pain, Harvard Business Review; March 2010, p28

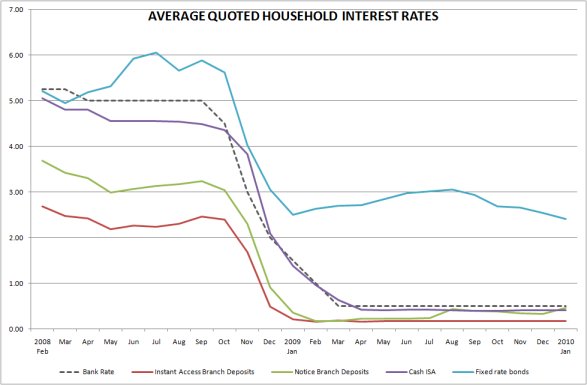

The picture for savings rates continues to be gloomy, with the first statistics on interest rates earned in 2010 published this morning

by the Bank of England. This is the first month that data for banks and building societies has been combined into a Monetary Financial

Institutions sector and this has impacted some of the figures.

Households earned a monthly average weighted rate of just 0.80% on their no notice deposits in January 2010, with branch based no notice

accounts paying only an average of 0.17%. The data for fixed term deposits was impacted by the change in basis, which increased the rates

by 0.1%. But the overall picture is much the same as last month, with new business rates being lower than historic rates. The average new

fixed term rate was 2.34%, some 18 basis points lower than the monthly weighted average rate at 2.52%. The graph shows the average

quoted household interest rates for the monetary financial institutions sector over the last two years.

Source: Bank of England, Bankstats Table G1.3, published 1st March 2010.

Source: Bank of England, Bankstats Table G1.3, published 1st March 2010.

There are no immediate signs of a respite for savers. Despite an upward revision from 0.1% to 0.3% in the Q4 UK GDP published last week, the market had expected more, meaning that the recovery is fragile. Both the UK and USA are expected to need low official rates for a longer period to stimulate growth.

|