Cash Adviser Blog

Where to Stash £1,000,000 25th January 2012

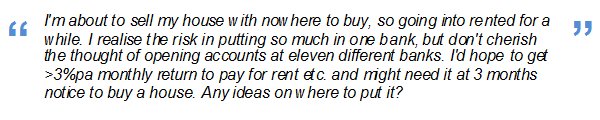

Question

This question was asked on a Citywire forum a few days ago and whilst there have been 49 responses to this question at the time of writing,

there was some questionable advice given. This made me think about how I would answer such a question, so here are my comments.

Risk Propensity

The writer of the question describes themselves as 'recently redundant and retired' and so from this I would deduce that they are probably

in their sixties and the £1m in question sounds like it is their entire life savings. Therefore they do not have the capacity to lose their

capital and so preservation of capital will be the primary aim.

They have identified the risk associated with putting all their cash in one bank and so default risk also needs to be addressed.

Liquidity Requirements

The writer mentions the need to generate an income to pay for rent and other outgoings and also a possible need to withdraw money at 3

months notice to buy a house. This means that liquidity is very important and the maximum time horizon is three months.

Suitable Asset Types

Given the need for capital preservation and the requirement for liquidity the only suitable asset types are cash deposits and National

Savings (NS&I). NS&I are backed by the UK Government and are considered to be as close to risk free as you can get. NS&I have seen an

influx of deposits recently due to a flight to quality. Their Direct Saver account, for example, pays 1.5% gross annual equivalent rate

(AER) and is taxable. The writer is expecting a return of 3% or more, so putting the whole £1m into National Savings will not meet their

income expectations and therefore cash deposits with banks and building societies will need to be included to get near to the target return.

Managing Default Risk

The Financial Services Compensation Scheme (FSCS) covers 100% of bank and building society deposits up to a maximum of £85,000 per person

per authorised firm. This means that joint investors are covered for £85,000 each and the amount held in a joint account will usually be

split 50/50 between the two account holders. It is important to note that the limit applies at the authorised firm level. In some financial

services groups there is only one authorisation across the group. For example, Bank of Scotland, BM Savings, Halifax, AA Savings, Saga and

St James Place Bank all come under the same authorisation of Bank of Scotland plc. You can check this on the FSA website as firms with the

same authorisation have the same FSA registration number. There is a

table on the FSA website giving details.

Non UK banks are not covered by the FSCS as they are covered by an equivalent European scheme which covers deposits up to €100,000,

which is approximately £83,500. This includes banks such as ING Direct, so check that you know which compensation

scheme you are covered by before investing.

The existence of compensation schemes mean that retail investors can make sure that their savings are protected by these schemes by

placing deposits up to this limit. Therefore £1m in a single name would require the opening of 12 accounts to ensure your savings are

fully protected. If you have joint accounts then only 6 accounts are needed.

Rates of Return

The good news is that whilst the Bank of England base rate has been at just 0.5% since March 2009, rates offered by banks to retail investors

have remained high in relative terms. For terms less than 3 months, the best rates are usually variable 'bonus rates' which apply for an

initial period to new investors. At the end of the bonus period, rates fall to the 'standard rate', which is typically around 0.5%. Often

immediate access rates can be higher than notice accounts because of bonuses. If you do choose an account with a bonus rate, diarise the

date the bonus expires so that you can move your money before then. Some banks allow you to give your account a name, so if the bonus expires

on 25th January 2013, call the account 25Jan2013.

The table below shows some currently available products and rates:

| Provider Name | Product | Notice Period | Gross AER | Bonus Period | Rate after bonus | Compensation Scheme |

| Shawbrook Bank | 95 Day Notice Personal Savings Account Issue 1 | 95 Day | 3.35% | none | 3.35% | FSCS |

| BM Savings (Bank of Scotland plc) note 1 | BM Online Extra (Issue 1) | none | 3.20% | 12 months | 0.50% | FSCS |

| West Brom | Direct Bonus account 3 | none, max 4 withdrawals | 3.13% | 28/02/2013 | 1.75% | FSCS |

| Nationwide | MySave Online Plus Issue 4 | none, max 1 withdrawal | 3.12% | 12 months | 1.51% | FSCS |

| Aldermore note 2 | 90 Day Notice | 90 Day | 3.10% | none | 3.10% | FSCS |

| krbs (One Savings Bank plc) | Internet 60 Day Notice | 60 day | 3.10% | 12 months | 2.10% | FSCS |

| Santander UK | e saver | none | 3.10% | 12 months | 0.50% | FSCS |

| Skipton BS | Online Bonus Saver | none | 3.05% | 12 months | 1.50% | FSCS |

| Post Office (Bank of Ireland UK) | Online Saver (Issue 4) | none | 3.01% | 12 months | 1.65% | FSCS |

| Leeds BS note 3 | Postal Bonus Saver Issue 2 | none | 3.01% | 31/01/2013 | 1.50% | FSCS |

| ING Direct N.V. | Savings Account | none | 2.90% | 12 months | 0.50% | Dutch central bank €100,000 (£83,581) |

| Virgin Money (Northern Rock plc) | Easy Access E-Saver | none | 2.85% | none | 2.85% | FSCS |

| Mansfield BS note 4 | Postal Premium 4 (4th Issue) | none, max 4 withdrawals | 2.85% | 12 months | 2.00% | FSCS |

| Principality BS note 5 | e-SAVER Issue 4 | none | 2.85% | 12 months | 1.65% | FSCS |

Notes:

Rates are correct as at 25th January

1 Annual interest, calculated daily. Minimum 50,000 investment. BM Savings is within Bank of Scotland plc for FSCS coverage

2 AER guaranteed to be 2.00% above Bank Base Rate Until 01/03/2013

3 Annual interest, calculated daily

4 Annual interest, calculated daily and paid on 30th June

5 Annual interest, calculated daily and paid on 1st January each year

The highest rate is for a 95 day notice account, which is 5 days longer than the 3 month maximum but this may be acceptable as the average

duration is 21 days. In this case the average rate is 3.08% over 12 accounts. If this account is not used the average rate falls slightly to

3.04% and the average duration reduces to 13 days.

Some of the accounts only pay interest annually but it is still calculated daily so it should have minimal impact. The advantage of monthly

interest is that this can often be paid to your bank account and so you do not need to make a withdrawal each month to take an income.

Two of the accounts have limits on the numbers of withdrawals so it is best to leave the cash in these accounts until it is needed to

buy the property and then close the account down. Ideally income should be taken from the lowest paying accounts first to boost the average

rate earned.

Conclusion

It is possible to find a solution that meets all the requirements but it does require opening 12 different accounts, which could be 11

accounts with £83,500 and one account with £81,500. It will be time consuming to do this, but the alternative is to use a cash

specialist to do this for you and they will charge a fee for arranging accounts for you.

Archived Commentary

A foggy picture for interest rates 31st August 2011

It will come as no surprise to you to know that I follow what is happening with interest rates pretty closely. But I have been surprised

how rates have changed this month.

..... more

The Psychology of Money 29th July 2011

I have presented a short insight called the Psychology of Money at various 4N networking groups.

The presentation is about our relationship with money and the way we make financial decisions and I use a series of questions to

demonstrate how the short cuts we use to break down complex financial decisions can bring bias into our decision making.

..... more

FSA Fine highlights issue in how risk profiling tool was used in assessing suitability 25th May 2011

The Financial Services Authority (FSA) has fined Bank of Scotland (BOS) £3.5 million for the mishandling of complaints about

retail investment products - many from older customers with little or no experience of investment products.

..... more

Are inflation linked savings a good idea? 12th May 2011

National Savings and Investments (NS&I) have re-launched their index linked savings certificates. Many commentators are comparing the

returns that people might expect to get from these certificates with fixed rate deposit accounts to see whether people are likely to "win"

or "lose"..... more

Behavioural Finance Conference: A twitter experiment 11th April 2011

I attended the Behavioural Finance Working Group (BFWG) conference at Cass business school, which was a good opportunity to update my

knowledge and network with like minded people including some from the LinkedIn Behavioural Finance group.

..... more

When is a savings bond not a savings bond? 7th March 2011

The short answer is when it is a John Lewis Partnership bond. This bond is described in the press release

as "a new five-year savings product", but reading the details shows that it is not what most people would think of as a savings product.

..... more

Where next for interest rates? 2nd February 2011

With the base rate at 0.5% since March 2009, it seems clear then that the next move will be upwards, but it's far from clear when rates

will start to rise. ..... more

Compensation Limit raised to £85,000 for deposits 4th January 2011

The deposit limits under the Financial Services Compensation Scheme (FSCS) have been increased with effect from 31st December 2010

from £50,000 to £85,000 for each person, per authorised firm. ..... more

Bank of England encourages spending rather than saving 28th September 2010

In an interview with Channel 4 News, Charlie Bean, Deputy Govenor of the Bank of England, explained that encouraging spending rather than saving was part of the point of monetary policy rather than a side effect of it.

..... more

Economy grows by 1.2% in Q2 but Double-Dip recession looms 27th August 2010

Figures published this morning by the Office of National Statistics showed that GDP increased by 1.2% in the second quarter of 2010,

the strongest quarterly growth in nine years...... more

CPI or RPI? What's the Difference? 23rd August 2010

In the UK there are two key measures of price inflation, the consumer price index (CPI) and the retail price index (RPI)

..... more

Does Inflation Matter? 16th August 2010

The simple answer is yes, but more importantly, will investment returns exceed inflation? To get growth in real terms it's the

difference between investment returns and inflation rates that is key.

..... more

The Power of Compound Interest 6th August 2010

A discussion forum on IFA Life has reignited my interest in compound interest. A post called "compelling compounding"

referred to an article with examples of the effect of compound interest on contributions over a long period of time

..... more

No easy way to beat inflation as NS&I withdraws index linked savings certificates 19th July 2010

NS&I announced that Index-Linked Savings Certificates have been withdrawn from general sale. It has also withdrawn Fixed Interest Savings

..... more

Economy grows by 0.3% 25th May 2010

Figures released this morning showed that Gross domestic product (GDP) increased by 0.3% in the first quarter of 2010.

..... more

Inflation Hits New Highs 19th May 2010

The latest UK inflation figures showed that CPI inflation for April 2010 was 3.7% and RPI reached 5.3%.

..... more

Interest Rate Outlook 27th April 2010

A number of data releases over the last week suggest that rates might start to increase sooner rather than later.

..... more

Interest Rates from Down Under 12th April 2010

Whilst the Bank of England decided to keeps rates steady at 0.5%, the Reserve Bank of Australia increased rates to 4.25% last week.

..... more

Inflation drops to 3% 23rd March 2010

Figures published by the Office of National Statistics today showed that Consumer

Price inflation fell from 3.5% p.a. in January 2010 to 3% p.a. in February.

..... more

Cash gives people an inner strength 8th March 2010

An article published in this month's Harvard Business Review finds that cash gives

people an inner strength and can reduce their physical and emotional pain.

..... more

Gloomy Outlook For Savers 1st March 2010

The picture for savings rates continues to be gloomy, with the first statistics on interest rates earned in 2010 published this morning

by the Bank of England. ..... more

MPC Minutes show inflation expected to stay high for now 17th February 2010

With inflation at 3.5%, some taxpayers will need to achieve 7% just to stand still..... more

Interest Rate Outlook 8th February 2010

With the Bank of England holding the base rate at 0.5% last week, there seems to be little prospect of rates increasing any time soon

..... more

|